The Only Go Digital Agency

You’ll Need to Work With

Proven

Reliable

Creative

Results Oriented

Web development agency, website design agency, digital marketing agency, digital solutions agency, web design company — we’re all of that and more. If your goal is to take your business from offline to online, we’ll be the only agency you need to go digital with.

Our Presence and

Staff Strength

Our Singapore headquarters is staffed by over 195 local employees supported by our offshore Manila team of 65. The FirstCom team is a medley of domain specialists working together towards one common goal: solve challenges and fuel client growth. From designers to digital marketing specialists, developers, producers — every role is in-house to provide you with a true one-agency experience.

Our Services

Whether you need to overhaul your website design, produce a promotional video or develop a full-funnel digital marketing strategy — we provide results-focused digital solutions and domain expertise to solve every business challenge on your digital marketing journey.

-

Social Media Marketing

Make waves with results-focused, data-led social media campaigns with original content creation to achieve your business goals.View More -

Google Marketing

As a Google Premier Partner, you’ll get experienced, certified consultants employing the best practices on your ad campaigns.View More -

Creative Production

With 3 studios and over 30 dedicated specialists, our in-house production team helps tell your brand story with powerful videos or stunning photography.View More -

Web Design & Web Development

Bespoke website design and web development that meets your business requirements and makes it easy for you to drive leads and convert visitors obtained through digital marketing efforts.View More

Rated 4.5 on

Our Accreditation

Want to get a sense of who we are? In our decade as a full suite digital marketing agency in Singapore, we’ve picked up many national awards and accolades for our work. Our digital marketing projects have been featured on news media and we’re consistently working with industry leaders to establish new partnerships and attain recognised certifications.

Check out the features, awards and accreditations under our belt and see if we’re the right fit for your business.

Our Clientele

We don’t just have the client volume, we are also the most reviewed web and digital marketing agency in Singapore – and our works are loved by our clients.

Works We Love

From web designs to artworks, photography, animation and videos — we’ve created countless creative assets in a multitude of styles for a variety of industries. Explore the best works from recent digital marketing and web development projects and see what our creative team can do for you.

-

Social Media Marketing

-

Video Production

-

Web Development

-

Branding

-

Photography

-

Homecook'd

-

Royal Max Picker

-

Black Society

-

Tankfully Fresh

-

Lasting Goodness

-

Nuvojoy

-

TREOO

-

ASIAEURO

-

Food & BeveragesIslandwide Korean Chicken! - Jinjja Chicken

-

RetailFirst & Only Organic Drip Chicken Essence - Papura Chicken Essence

-

Food & BeveragesKpop Cafe & Restaurant - Nayana

-

ServicesProfessional Tyre Solutions - Mrrjestic Tyres

-

Corporate & EventsHeartland Innovation Challenge Program - Federation Of Merchant's Association Singapore

-

Food & BeveragesHalal Ramen Galore! - Goshin Ramen

-

RetailHigh End Jewellers - DeFred

-

Food & BeveragesYeast Side (Video Produced By FirstCom Solutions)

-

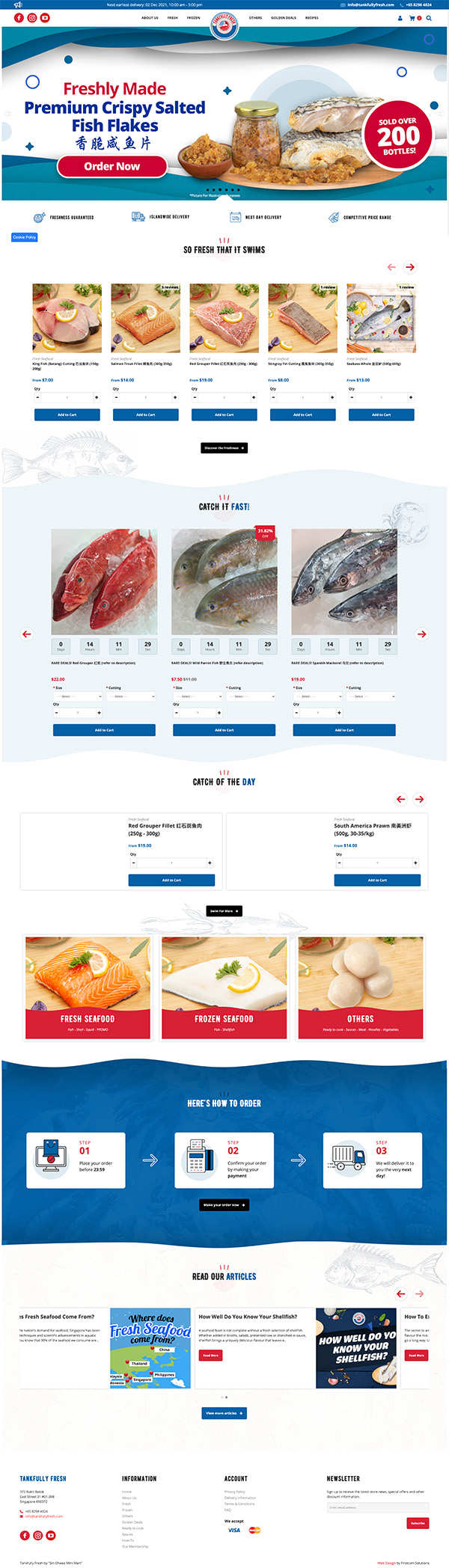

E-CommerceTankfully Fresh

-

CMSWatchFund

-

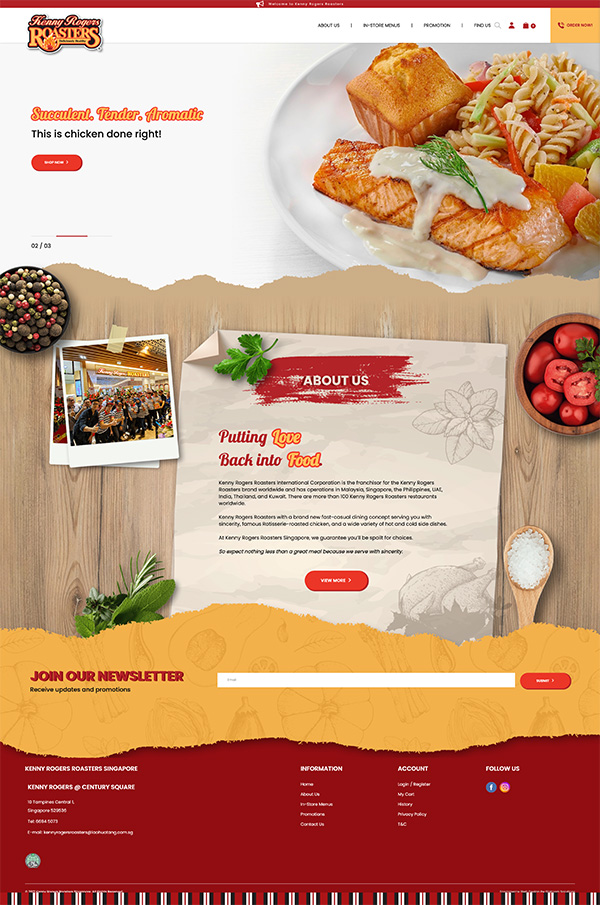

E-CommerceKenny Rogers Roasters

-

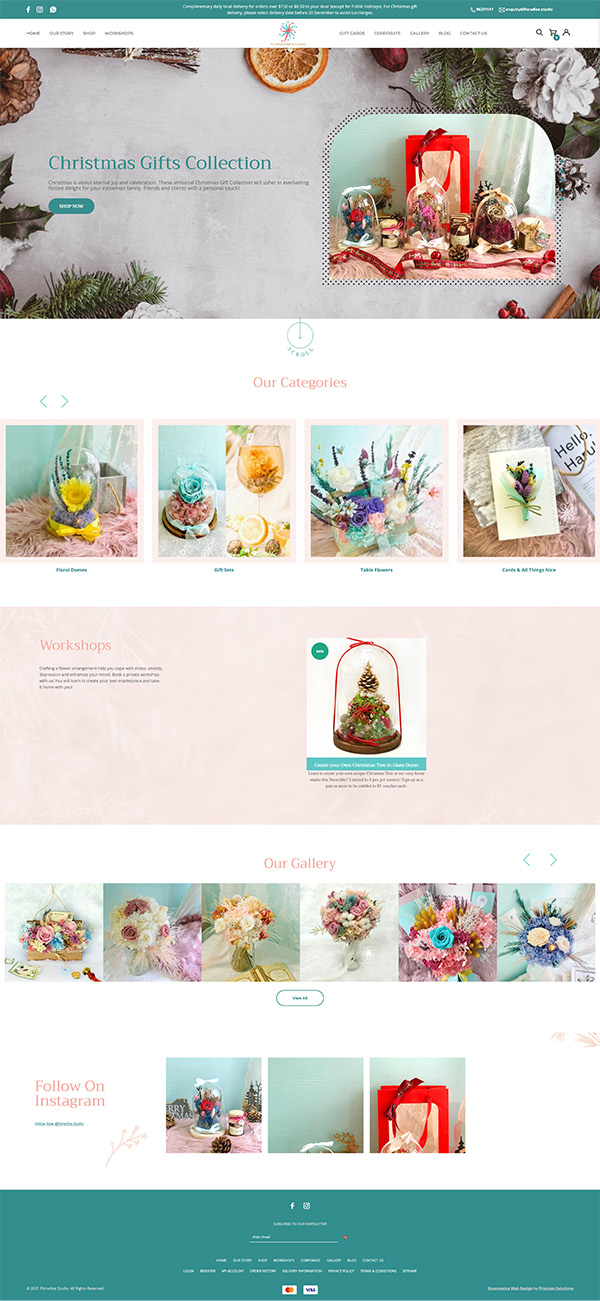

E-CommerceFloradise Studio

-

E-CommerceSonic Clean

-

CMSAI Hub

-

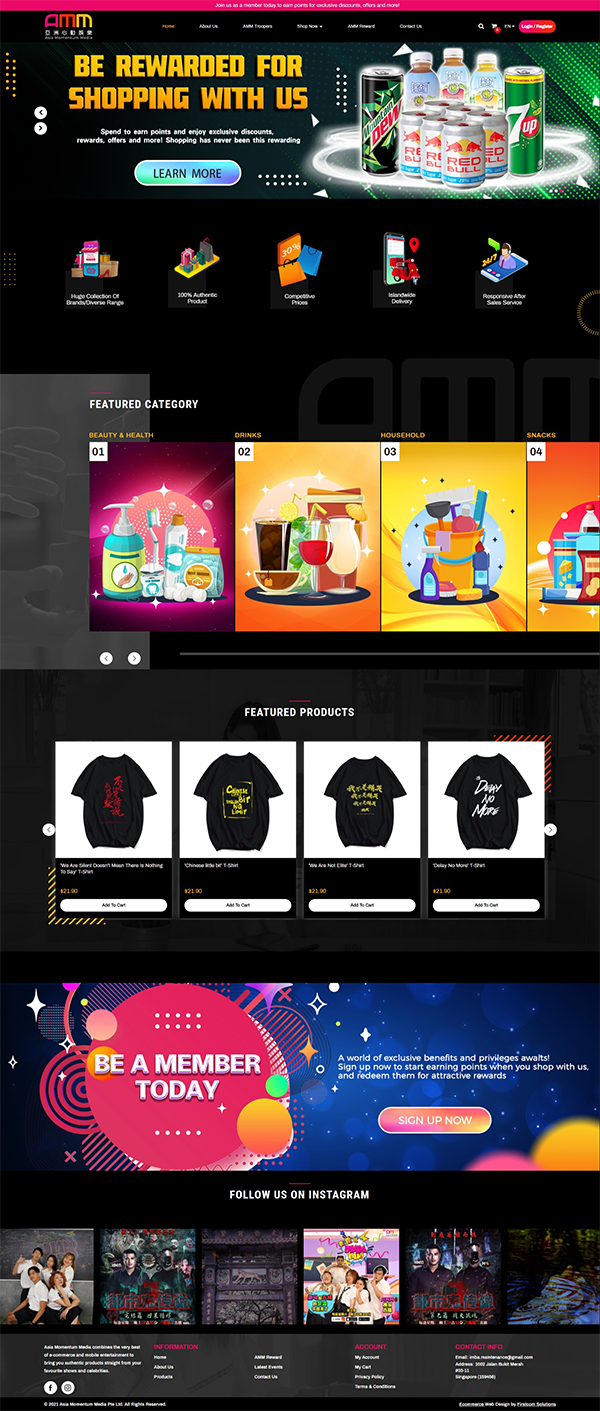

E-CommerceAsia Momentum Media

-

Landing PageTakashimaya CNY 2019

-

Brochure DesignK Friends

-

Logo DesigniFMF Investment Academy

-

Brochure DesignWin Mart

-

Packaging DesignSlurps

-

Packaging DesignOhdiolab

-

Namecard DesignBooze Infusion

-

Namecard DesignCool Tiger

-

Namecard DesignSneakers Clinic

-

Food & BeveragesTeafolia

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

-

Food & BeveragesBlanco Beef Noodles

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

-

Food & BeveragesLilac & Oak

![]()

![]()

![]()

![]()

![]()

![]()

![]()

-

Retail & ServicesFoveo

![]()

![]()

![]()

![]()

![]()

![]()

![]()

-

Retail & ServicesCuddly Gently

![]()

![]()

![]()

![]()

![]()

-

Retail & ServicesAsia Euro Wine

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

-

Corporate & EventsDr Foot Podiatary

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

-

Corporate & EventsLim's Legacy

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

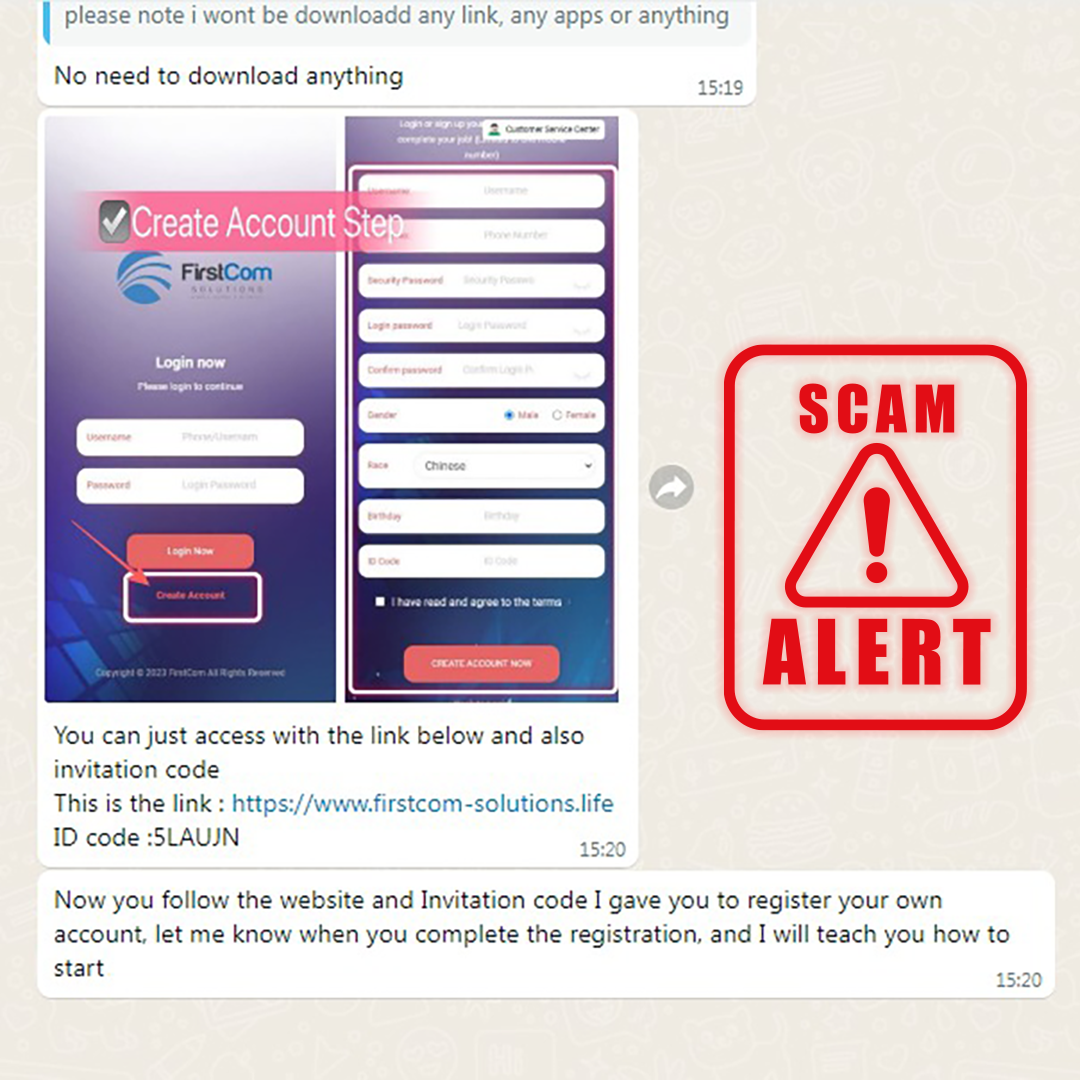

Building On a Decade of Web Design and Web Development

FirstCom Solutions is the largest and most experienced web design company in Singapore and the web design agency of choice for Singaporean businesses. For over 10 years, we’ve provided small businesses with relevant web design and development services — developing creative and professional websites with responsive designs, great user experience and friendly user interfaces.

Our team of experienced in-house website designers and web developers work hand-in-hand to build a custom website with unique design elements and functional elements tailored for each business. After launch, our website maintenance team provides 24/7 support to take care of your web security and web hosting matters.

To meet the needs of our clients, we’ve continued to expand on our web development expertise and become a one-stop digital agency; providing complementary digital services like digital marketing, social media marketing, search engine marketing and content creation to ensure sustained online success well after a website is launched.

Send us a message!

Do not worry, your email isn’t going to the inbox abyss, never to be seen or heard again! Arrange for a no-obligation consultation with our certified digital marketing and project consultant to start your journey online.

Articles and Blog

From the latest case studies to SME-aligned perspectives on digital marketing, ecommerce, content creation trends and other knowledge bites to help you stay ahead of the curve.